Of course, it’s best practice to deposit a check as soon as you receive it, which is why most checks include language encouraging a timely deposit. An outstanding check refers to a check that has not yet been deposited or cashed by the recipient. In other words, it has already been written and delivered to the recipient, but the recipient (or the recipient’s bank) has not yet processed the check, which would result in a draw on the issuing account. Like business checks, personal checks are generally considered invalid after six months (180 days).

Fact Check: Donald Trump Did NOT Owe Money To Bozeman Airport — Plane Diversion Due To Mechanical Reasons

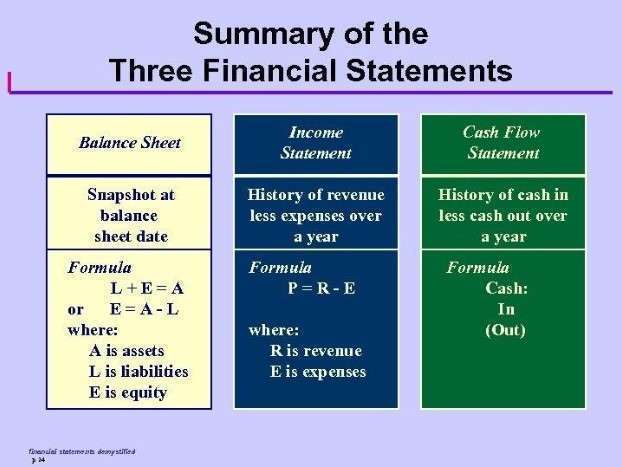

It’s commonly used to receive direct deposit of paychecks, pay bills, make debit card transactions and withdraw cash. While a savings account may be where you store money for emergencies or financial goals, money moves in and out of your checking account frequently. This is why your (or company) bank accounts need to be reconciled with the bank statement. There is a discrepancy between what your checkbook or accounting system says you have in your account and what the bank reports on your monthly statement. One of the main differences are the an outstanding check is one that has not yet been issued.s that have been recorded in the accounting system but haven’t been recorded by the bank. Until it has been deposited and cleared, outstanding checks are liabilities on the payor’s balance sheet.

Our Services

Instead, the amount for which the check is written is a substitute for physical currency of the same amount. + Plus, detailed guides to maximizing the value you get from your new US bank account. If so, you can get access to GlobalBanks USA (our dedicated US banking service) in just a few clicks.

Outstanding Business Checks

- Make sure to cash your federal tax refund check no later than a year from the date it was issued.

- Beyond that, it is up to the bank’s discretion, which may include contacting the account holder for approval.

- Our team of reviewers are established professionals with decades of experience in areas of personal finance and hold many advanced degrees and certifications.

- They represent pending transactions where the funds have not yet been deducted from the issuer’s account.

- This makes it easier to set expectations and gives them the opportunity to plan properly.

- This means the money is briefly double-counted until the payer’s bank clears the check.

- Other factors, such as our own proprietary website rules and whether a product is offered in your area or at your self-selected credit score range, can also impact how and where products appear on this site.

This typically occurs after a few years, but timetables vary from state to state. If you write a check and the money never leaves your account, you may develop the false belief you can spend those funds, but the money still belongs to the payee. If the payee finally deposits the check after months of delay, you risk overdrawing your account and bouncing the check. Checks are simple financial tools that depend on both the payor and payee to take action to complete the payment.

Other checking account fees can include a monthly service fee, a per-check fee (a charge for every check you write), a check printing fee, and a returned deposit item fee. A returned deposit item fee is charged when you deposit a check in your account that bounces. Some businesses print “Void after 90 days” on their checks to encourage recipients to deposit checks more promptly. Most banks will continue to honor checks for the full 180 days, but that isn’t guaranteed.

What is your current financial priority?

Another type is a payroll check, or paycheck, which an employer issues to compensate an employee for their work. In recent years, physical paychecks have given way to direct deposit systems and other forms of electronic transfer. While not all checks look alike, they generally share the same key features. The name and contact information of the person writing the check is located at the top left.

The interest earned is added to the book balance to show the increase in the ratio resulting from the interest deposit. A check hold is the amount of time a bank can withhold funds deposited by check before crediting the customer’s account. Typically, the customer cannot access some or all of the funds until the hold ends and the check clears.

Holding on to checks for a long time also increases the likelihood that they will get lost or destroyed before they are cashed or deposited. If that money is spent on something else, you may not have enough money in the bank account to cover all your promises to pay. As a result, your bank account balance may fall below $0 and incur overdraft fees. It’s possible that the bank could also decline to honor the outstanding check, as well.

A bounced check — also called a rubber check — happens when you’ve written a check and don’t have enough funds in your account to cover it. If you’ve written someone such a check and they deposit it at their bank, their bank sends it back to you — the account holder — and your bank may charge you a fee for having non-sufficient funds (NSF). It’s always best to contact the issuer before trying to cash a stale or outstanding check. Such a call may be awkward, but it’s better than imposing an overdraft fee on the person or business that wrote it. Beyond that, it is up to the bank’s discretion, which may include contacting the account holder for approval. The bank also can simply bounce the check without even trying to reach out, which means the depositor may get hit with a “deposit item returned” fee that can be up to $30 or more.

Banks are still allowed to process an older check, if the institution believes the funds are good. A cashier’s check is guaranteed by the banking institution and signed by a bank cashier, which means the bank is responsible for paying the funds. This type of check is often required for large transactions, such as buying a car or house. The GlobalBanks editorial team comprises a group of subject-matter experts from across the banking world, including former bankers, analysts, investors, and entrepreneurs. All have in-depth knowledge and experience in various aspects of international banking. In particular, they have expertise in banking for foreigners, non-residents, and both foreign and offshore companies.